We're on an Apollo 13 mission: Gen Kranz the Flight Director at the time said,"When bad things happen, we just calmly laid out all the options and failure was not one of them". Tough and competent, "we are forever accountable for what we do or fail to do. We will never take anything for granted. We will never fall short of our knowledge or our skills".

Saturday, June 30, 2018

2018 Bank Stress Test

The Fed has released the results of its most recent Dodd-Frank Stress Tests. This year, 18 of the largest and most complex banks were subject to both the quantitative and qualitative assessments. The 17 other firms in Comprehensive Capital Analysis and Review (CCAR) were subject only to the quantitative assessment. Decisions as a manager, you take into account qualitative factors like reputations, brand strength and employee morale, as well as quantifiable data such as sales figures, profitability and return on investment. Quantitative factors include a firm's projected capital ratios under a hypothetical scenario of severe economic and financial market stress. Qualitative factors include the strength of the firm's capital planning process, which incorporates risk management, internal controls, and governance practices that support the process.

The Board objected to the capital plan (share buybacks) from Deutsche Bank USA Corporation due to qualitative concerns. Due in part to recent changes to the tax law that negatively affected capital levels. The cut in the corporate tax rate from 35 per cent to 20 per cent cut the value of deferred tax assets. Furthermore, Trump tax reforms eliminated a beneficial tax treatment that had enabled banks to smooth their earnings by carrying losses forwards or backwards from periods of crisis.

The Fed failed the U.S. subsidiary of Deutsche Bank AG, citing widespread and critical deficiencies in its planning, limiting the unit’s ability to send capital home to Germany.

Goldman Sachs Group Inc. and Morgan Stanley agreed to freeze payouts at previous years’ levels. Both banks were required to rein in their dividend and stock buyback plans after the Fed warned their initial, more bullish, proposals would have left them with inadequate capital buffers.

JPMorgan Chase, American Express, KeyCorp and M&T Bank Corporation also rethought their original plans for payouts to shareholders, although they got the thumbs up after submitting more modest plans in the past week, the Fed said.

List of Banks moving forward with capital planing and distributions to share holders.

Ally - Buy Back $1b Shares, raise dividend to 15c/shr from 13c/shr

American Express - Buy Back $3.4b Shares, raise dividend to 39c/share, from 35c/share

Bank of America - Buy Back $20.6b Shares, raise dividend to 15c/shr

Capital One - Buy Back $1.2B Shares, keeps dividend at 40c/shr

Citi - Buy Back $17.6b Shares, raise dividend to 45c/shr from 32c

Goldman Sachs - Buy Back $5.0b Shares, raise dividend to 85c from 80c

JPMorgan Chase - Buy Back $20.7b Shares, raise dividend to 80c/shr from 56c/shr

Morgan Stanley - Buy Back $4.7b Shares, raise dividend to $0.30/shr from $0.25/shr

PNC Financial - Buy Back $2.0B Shares, raise dividend to 95c/shr from 75c/shr

U.S. Bancorp - Buy Back $3B Shares, raise dividend to 37c/shr from 30c/shr

Wells Fargo - Buy Back $24.5b Shares, raise divined to 43c/shr up from current 39c/shr

Board of Governors of The FRS

Dfast-Methodology-Results

Global debt rose to a record $233 trillion in the third quarter of 2017. According to the most recent data (6/6/18) from the Bank for International Settlements (BIS), the total notional amounts outstanding for contracts in the derivatives market is an estimated $542.4 trillion!

Some Chart Porn

Now not so Good News

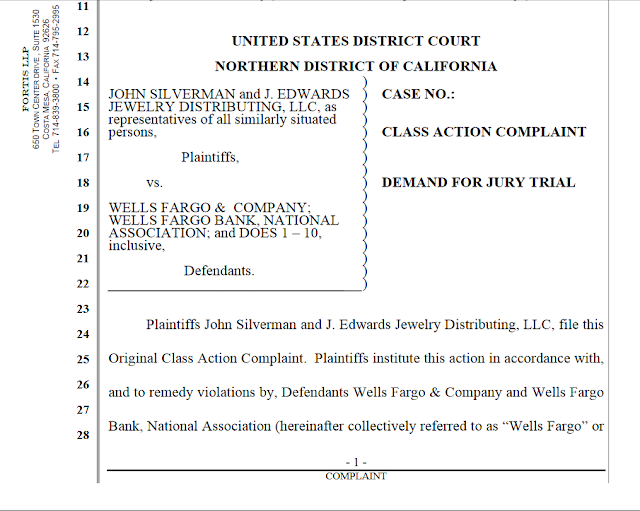

6/28/18 - Wells Fargo Class Action

In violation of the Truth in Lending Act, Wells Fargo has created and maintains a credit card program through which it actively encourages retailers to build the “fees” that these merchants must pay Wells Fargo into the regular-price of goods and services, while representing to retail consumers that the goods and services that they purchase are being financed at zero percent interest. In reality, Wells Fargo’s financing scheme results in the creation of illegal hidden finance charges, and the imposition of double-digit interest rates on consumers. (still making money the old fashion way, steal it!)

6/28/18 - Former Chief Financial Officer of Bankrate Inc. Pleads Guilty

Edward J. DiMaria, 53, of Fairfield County, Connecticut, pleaded guilty to one count of conspiracy to make false statements to a public company’s accountants, falsify a public company’s books, records and accounts, and commit securities fraud; and one count of making materially false statements to the Securities and Exchange Commission (SEC). The scheme caused more than $25 million in losses to Bankrate’s shareholders.

“The consequences of this type of financial fraud scheme are far reaching, affecting not only the economy in the United States, but also the world’s financial markets,” said Inspector in Charge Adame. “Those who engage in this type of abuse of power while in positions of authority should know they cannot escape detection. They will be found and they will be held accountable for their actions. The U.S. Postal Inspection Service has a long history of investigating complex financial fraud schemes, like this one, in order to protect investors and the integrity of the financial marketplace.” (end DOJ news)

It's good to see many Banks raising dividends for shareholders and increasing capital position. But we're not out of the woods yet, we're still seeing market manipulation which has been with us since inception and what's good about that it's being exposed.

Be careful out there and stay frosty, luck is not a factor.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment